Westward ho! US clears way for giant Gateway South clean power trunkline

Warren Buffet-owned PacifiCorp sees construction of 670km line beginning next month and coming into service in 2024 to transport 2GW of wind and solar from Wyoming

PacifiCorp, a utility holding company that is part of Warren Buffett’s Berkshire Hathaway conglomerate, anticipates construction will begin next month with the system brought into service in late 2024.

About 60% of the project route in Wyoming south through Colorado and Utah is located on federal lands, mostly administered by the Bureau of Land Management (BLM), and the balance on private and state-owned properties.

In January, five presidential cabinet departments inked a memorandum of understanding (MoU) to “prioritise and expedite” federal government coordination and streamline reviews for this purpose.

In fiscal year 2021, which runs from 1 October–30 September 2022, BLM has so far authorised or facilitated 12 projects totalling 2.9GW, a 35% increase from the prior year. Except for 100MW of geothermal, the balance was solar.

Looking ahead, DoI forecasts that BLM in fiscal year 2022 will permit 3.6GW of capacity, in 2023 5.6GW, in 2024 13.5GW, and in 2025 6.9GW.

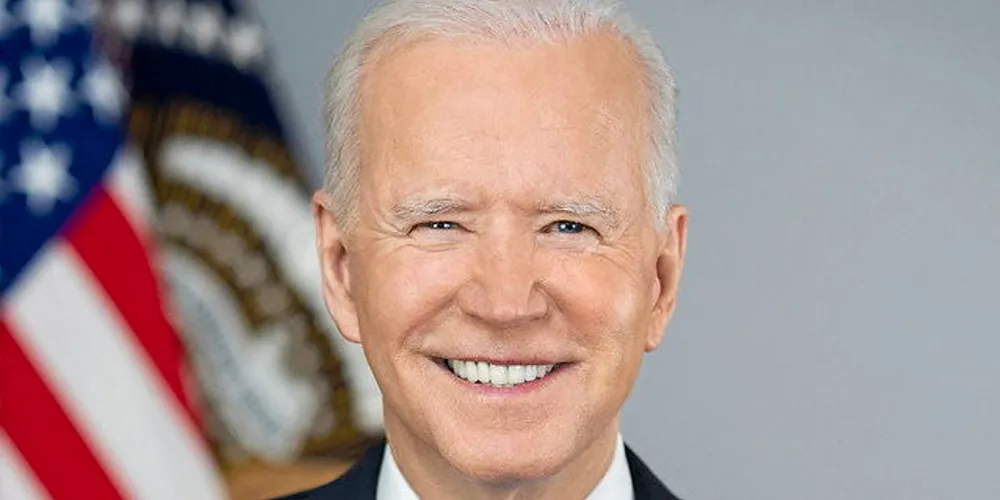

President Joe Biden views expansion of renewable energy development on federally owned properties as a key driver to help achieve a carbon-free electric grid by 2035. New, long-distance, interstate transmission will play a critical role in delivering greater volumes of clean energy to market.

“BLM-managed public lands will continue to serve an important role in modernising the nation’s infrastructure as we advance President Biden’s goal of achieving a net-zero economy by 2050,” said Tracy Stone-Manning, director of BLM.

While critical to integrate renewable resources and maintain a reliable grid, transmission build is on a “worrying downward trend”, according to a report issued earlier this month by Washington, DC-based industry advocacy body the American Clean Power Association (ACP).

Activity this year and in 2023 will be “lacklustre” although projects in development – if approved, financed, and built – could deliver an additional 5,000 miles by 2025.

Permitting merchant long-haul transmission is particularly costly and time-consuming given involvement by multiple inefficient federal agencies and states, and opposition from some landowners and vertically integrated investor-owned utilities.

Investors have generally been unwilling to tie up capital for up to a decade and sometimes more given lengthy litigation from opponents and uncertain regulatory outcomes.

Utilities have had better success advancing certain projects. Gateway South, for example, is part of PacifiCorp’s larger Energy Gateway Transmission Expansion, a multi-year plan to add 2,000 miles of new lines across its service territory comprising six western states. Utilities recover costs from the rate base plus a profit margin as high as low double-digits on their investment.

(Copyright)