'Vast sea ripe for turbines': shipowners riding offshore wind's vessel boom

ANALYSIS | Eric Priante Martin offers a shipping industry perspective on the current surge in demand for WTIVs in a guest contribution from Recharge's sister title TradeWinds

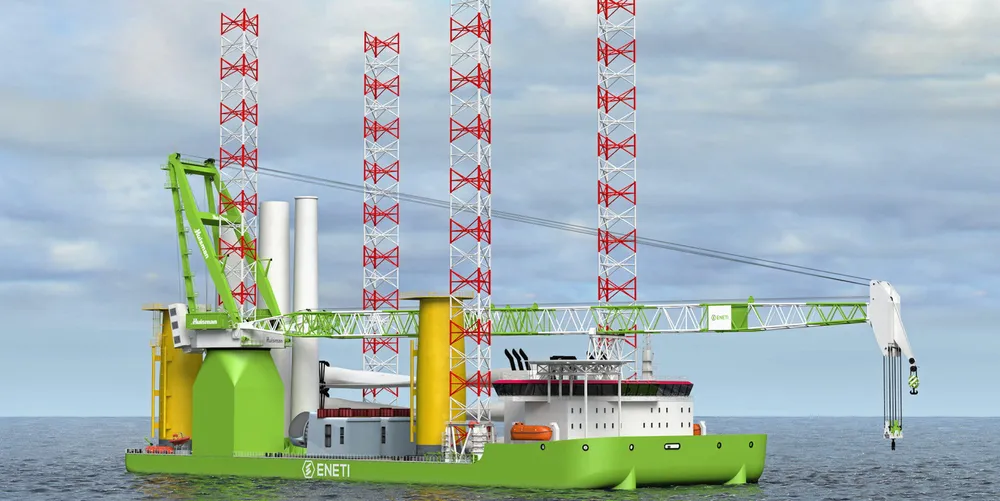

When Eneti this year struck a deal to order a large $325m wind turbine installation vessel (WTIV) in South Korea, the shipowner was continuing its drive into a market that is expected to grow as offshore wind projects opt for larger and larger turbines.

But you couldn't have expected the owner to have a long-term contract in place to employ the vessel. WTIVs just don't work that way.

These specialised vessels have market fundamentals that players in the offshore drilling sector will be familiar with: they're expensive to build but typically operate on short contracts to serve an offshore wind project for a year or two, before moving on to their next job.

Those dynamics have fuelled boom-and-bust swings in the oil and gas drilling sector.

And for WTIV players such as Eneti, that highlights the first-mover advantage: you want newbuildings to land in time to catch the wave as it is rising, not when it's already crested.

And there is a wave of offshore wind projects expected that will use extra-large turbines and support demand for these big WTIVs.

There is hope for the demand line to continue to grow, and analysts see Eneti's recent order for a second WTIV as a way to get in the ground floor of the expected surge in demand for these vessels.

"Being a first-mover in a growing industry, I would argue, is beyond the key to being successful," said Gregory Lewis, a BTIG analyst who takes a bullish stance on Eneti's New York-listed shares.

The latest order from Eneti means there are 11 of these WTIVs on the orderbook with delivery through to 2025. The majority of those will be able to accommodate the 20MW turbines of the future.

Future-proofing fleets

"With this increase in turbine sizes that have been going so rapidly, I think they're trying to future-proof their fleet," Martin Lysne, an analyst on the energy service research team, said of these orders

Lysne said he does not expect an immediate rush for more vessels beyond that, but more large WTIVs will be needed for delivery ahead of 2030 as existing ships are increasingly unable to handle the size of turbines being installed.

Future slump risks

There are risks for future slumps in WTIV utilisation, for example, if projects start to gravitate towards floating wind, which does not require WTIVs, and vessels are employed in lower-yield operations and maintenance work.

Fortunately, the short-term nature of WTIV employment contracts has also served to stave off over-ordering, which may help prevent the deep slumps seen in drilling rigs.

Analysts see plenty of demand ahead to support the vessels currently planned, and Eneti's order is seen as a safe bet.

The Monaco company's two newbuildings at DSME are scheduled to land in 2024 and 2025, which is an opportune time as the offshore wind activity ramps up and the focus on larger turbines becomes more widespread.

"The second half of this decade is going to be very busy," said Alexander Flotre, vice president for offshore wind at Rystad.

Lewis pointed to the rising number of countries committing to carbon neutrality by 2050 in connection with the recent United Nations' COP26 climate conference. Offshore wind will have to play a key role in meeting those commitments, because of space constraints for other renewable power sources.

- This article appeared in the Green Seas newsletter published by TradeWinds, subscribe here.