US greenlights 11th project with Ocean Winds' SouthCoast to Massachusetts ROD

Record of Decision by BOEM brings nation's total to nearly 20GW of capacity that could go into construction before decade's end

US federal regulators approved the eleventh offshore wind array today, Ocean Winds' 2.4GW SouthCoast project off Massachusetts, raising construction-ready capacity to nearly 20GW, enough to sustain development through the four years of President-elect Donald Trump’s upcoming term.

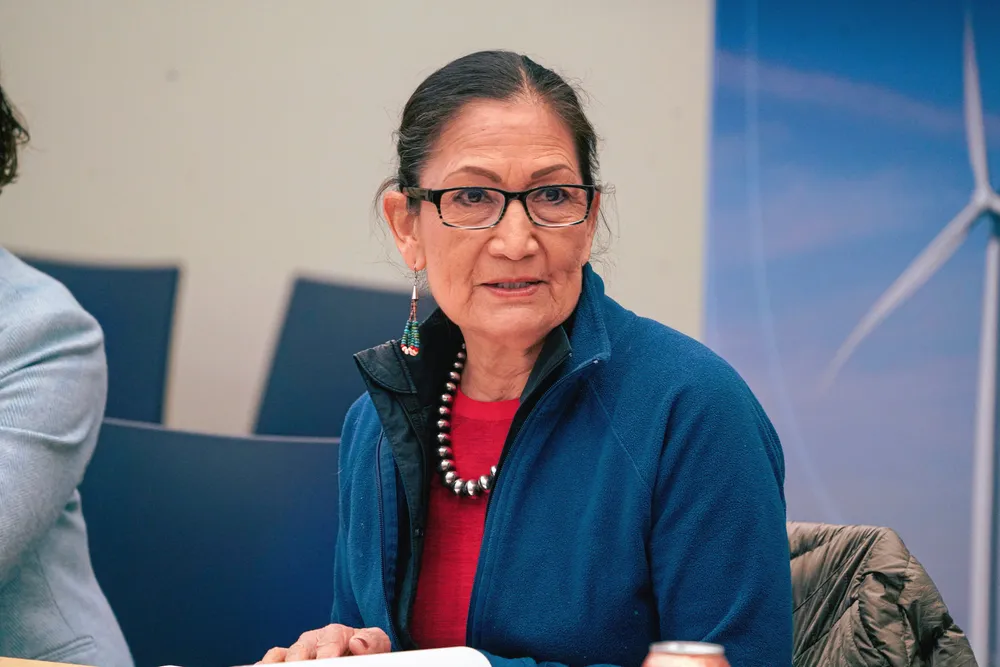

“When we walked in the door of this Administration, there were zero approved, commercial-scale offshore wind projects in federal waters. Today, I am proud to celebrate our 11th approval, a testament to the commitment and enduring progress made by the hardworking public servants at the Department of the Interior (DoI),” said Secretary of the Interior Deb Haaland.

The Record of Decision (ROD) issued by coastal energy regulator Bureau of Ocean Energy Management (BOEM) under DoI set the project up for onshore construction.

Once it receives the final greenlight on its Construction and Operations Plan — potentially before Trump takes office 20 January — it can head into offshore installation.

“The approval of the SouthCoast Wind Project today demonstrates the strength of our collaborative process to deploy offshore wind. To help inform our decisions, our environmental reviews continue to integrate leading scientific research with key insights from Tribal Nations, states, other government agencies, industry, environmental groups, and ocean users,” said BOEM director Elizabeth Klein.

Located in the Massachusetts wind energy area (WEA) 23 miles (37 km) south of Massachusetts, SouthCoast is approved for 141 turbines and up to five offshore substation platforms that could eventually power 840,000 homes.

The “ROD brings us a step closer to delivering abundant, domestic energy to New England’s homes and businesses,” said Michael Brown, CEO, SouthCoast Wind and Ocean Winds North America.

Along with SouthCoast, Massachusetts contracted 791MW of Iberdrola-controlled Avangrid’s likewise federally approved New England array and another 800MW of Copenhagen Infrastructure Partners (CIP)’s Vineyard Wind 2.

Avangrid and CIP are partnered on US flagship array, the 800MW Vineyard Wind 1 that was greenlighted months after Biden took office in 2021, bringing the Bay State total to 3.39GW.

The project paid a fine of $60m but was otherwise not penalised.

Capacity to spare

The approval allows for another gigawatt of project capacity, putting SouthCoast in good position to meet future procurements in southern New England.

Massachusetts mandates 5.6GW by 2027, with Rhode Island looking for around 1.2GW by 2031 and Connecticut 2GW by 2040 at the latest.

To meet its net-zero by 2050 ambitions, Massachusetts might be in for another 15GW beyond its mandate.

Only a little more than half of some 19.8GW greenlighted by BOEM has state offtake contracts. The extra capacity could be bid into future state offtake rounds and constructed before the end of the decade.