'Tremendous opportunity' | HVDC technology key to modern US transmission grid: report

Brattle Group and DNV in study highlight cost-effective HVDC solutions as nation aims for 2035 carbon-free power

US electric grid operators lag far behind global counterparts in deploying high-voltage direct current (HVDC) lines, despite the need to dramatically expand the nation’s transmission capacity to efficiently move low-cost renewable power long distances, and to meet increased demand and ensure reliable supply, according to a new report.

“HVDC technologies offer a tremendous opportunity for the US to upgrade and expand its aging transmission system, but we need to act now to address obstacles preventing greater domestic deployment,” said Johannes Pfeifenberger, principal with The Brattle Group and report co-author.

The report was prepared by Brattle and DNV for sponsors American Council on Renewable Energy; Allete, a midwestern utility; Clean Grid Alliance, an advocacy group; Grid United, a merchant transmission developer, and Pattern Energy, a leading independent transmission and wind developer.

The report highlights HVDC technologies as cost-effective solutions for bulk high-capacity, long-distance transmission that can offer advantages compared to conventional, high-voltage alternating current (AC), including reduced grid congestion, supporting weak AC grids, and improving grid stability.

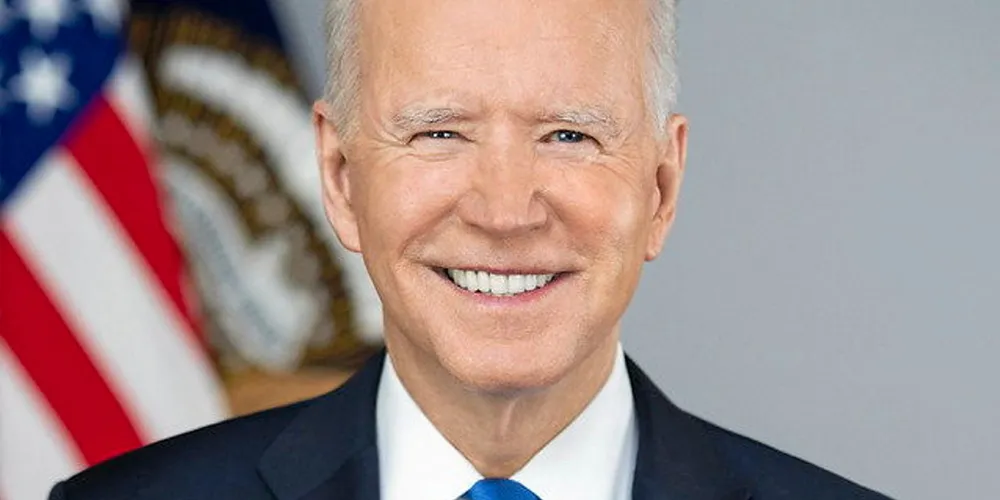

President Joe Biden has set a target of 100% carbon-free electricity by 2035 versus 22.6% last year. To get there, the US would need to triple its generation capacity from 2020 levels, including the addition of 2TW of solar and wind energy, according to the National Renewable Energy Laboratory.

Bringing much of that additional capacity to market would require upgrading the grid and a massive construction programme for inter-regional heavy-duty transmission lines.

Pfeifenberger notes that planning and developing valuable HVDC solutions “will require close collaboration between grid operators and various stakeholders, including industry groups, regulators, manufacturers, and the federal government.”

The report details how European grid operators have led the way in deploying modern HVDC technology based on voltage source converters (VSC) in recent years, with about 50GW of projects operating and another 130GW planned over the next decade.

North America, by contrast, has only 3% of all VSC-based HVDC systems in operation worldwide and, mostly due to efforts by merchant transmission developers, 30% of planned and proposed VSC systems.

Supply chain stress

The report underscores that HVDC technology is presently experiencing supply chain challenges that are perhaps even worse in the US.

“Historically, the HVDC market has been rather small and with limited production capacity, and as a result, the strong current worldwide growth in uptake of HVDC technology is straining existing supply chains for both system components as well as special transport and installation equipment,” it said.

There are only three main Western converter vendors and OEMs for HVDC converter equipment: GE Vernova, Hitachi Energy, and Siemens Energy. These vendors rely on sub-suppliers and partners for components and services.

Many of these supply chains are experiencing constraints due to recent, large-scale European HVDC developments, often involving offshore wind projects. As a result, current delivery dates for new orders of HVDC converters and cables are in the early 2030s.

That’s bad news for the US, which lacks domestic manufacturing of HVDC converters and components. With wind-related offshore and long-haul onshore transmission projects taking so long to permit, demand here for HVDC devices has been almost non-existent.

“Today, the supply chain issues are so pronounced that they are often seen as the number one risk to an HVDC project,” said the report, citing among other things an increase in costs (coupled with inflation) and lead time, and a decrease in vendor flexibility.

Supply chain pressures globally are providing an impetus for vendors to invested in greater production capacity and open new factories such as cable plants by Nexans and Prysmian in the US.

(Copyright)