'Sign of resurgence'| US grid-scale solar a clean energy bright spot as Q3 installs double: S&P

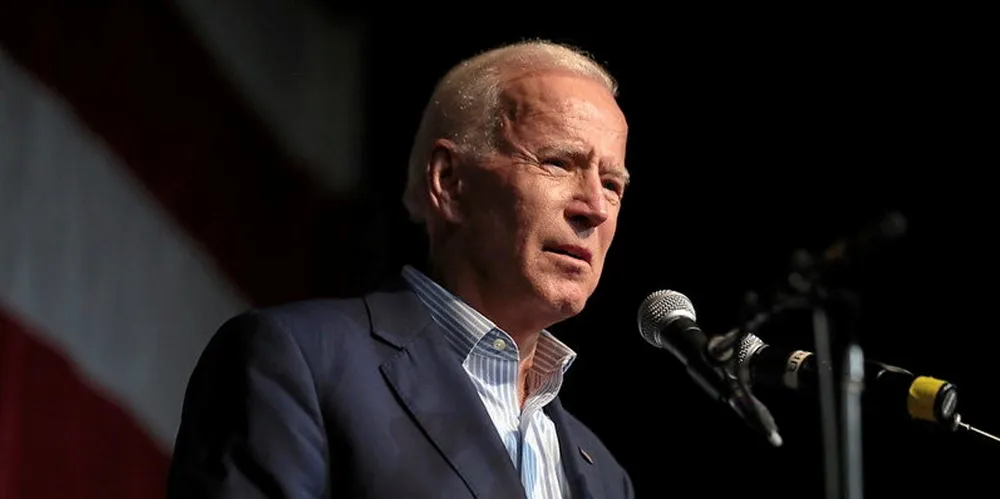

Strong performance a much-needed dose of good news for industry and President Joe Biden's administration

US project developers installed 4.13GW of utility-scale solar power capacity in the third quarter, the most for that period this decade, and a 107% jump from a year earlier, according to new data from S&P global Market Intelligence.

The analytics firm called the result “a sign of a resurgence of an industry battered by inflation and supply chain constraints.”

The strong performance was also welcome relief for President Joe Biden’s administration which has been on the defensive since this summer over a stream of negative news surrounding offshore wind project cancellations, consumer resistance to high-priced electric vehicles, and political gridlock in Congress that has undermined White House-backed bills to overhaul inefficient federal permitting processes for energy infrastructure.

Inflation has been a major industry concern for the past several years, squeezing developers’ margins and forcing them to raise PPA prices, making renewable energy less cost-competitive in certain regions of the country. Pressures have begun to abate.

Annual US Inflation eased to 3.2% for the 12 months ended October, compared with 6.5% in 2022 and a four-decade high of 7% in 2021. While frequency and severity of price hikes for equipment rentals, logistics, and materials have subsided, the Federal Reserve has kept its benchmark interest rate at a 22-year high.

Last month, Fed officials said there were no immediate plans for policy loosening given their twin focus of returning inflation to the central bank’s 2% target while avoiding excessive monetary tightening.

High interest rates have kept project financing costs high although corporate and utility demand for solar energy remains robust in most regions of the country despite higher PPA pricing.

The supply chain is now more fluid than a year earlier with more than 39GW of foreign-made solar panels having flooded into the US this year through three quarters. The industry is ramping inventory levels with looming 6 June expiration of a waiver on import duties on certain Chinese-branded products from Southeast Asia.

In the third quarter, developers energized 500MW PV projects in Nevada and Texas, while all nine others were more than 100MW each.

So far in 2023 developers have connected 10.34GW of utility-scale solar power capacity to US electric grids, an increase of 36% from a year earlier, according to S&P.

As of 31 August, there was 80GW of utility solar installed, according to the US Energy Information Administration, which last month forecast that solar energy output will surpass that of hydroelectric power in 2024. EIA is the statistics arm of the Department of Energy (DoE).

S&P noted that lucrative federal tax incentives available in the landmark 2022 climate law and DoE financing “are creating a scramble among developers to secure positions in backed-up interconnection queues.”

Most of the roughly 1.8TW of power capacity in the queues is renewable with solar the leading technology followed by battery storage and onshore and offshore wind.

The Biden administration anticipates that solar will be the workhorse clean energy technology by 2035, which is the target he set for a carbon-free grid.

On 30 September, the five-year pipeline for new grid-scale solar energy projects was nearly 204 GW. Roughly half of that capacity is in the early development phase, according to S&P.

About 10.3 GW of projects are in advanced development; 37.7 GW are under construction; and 54.5 GW of the capacity represents announced projects.

(Copyright)