Orsted exits floating wind project as Norwegian supplier seizes opportunity

Orsted began retreating from floating offshore wind in early 2024 and the sale of Salamander could raise questions about it's commitment to the 1GW Stromar project

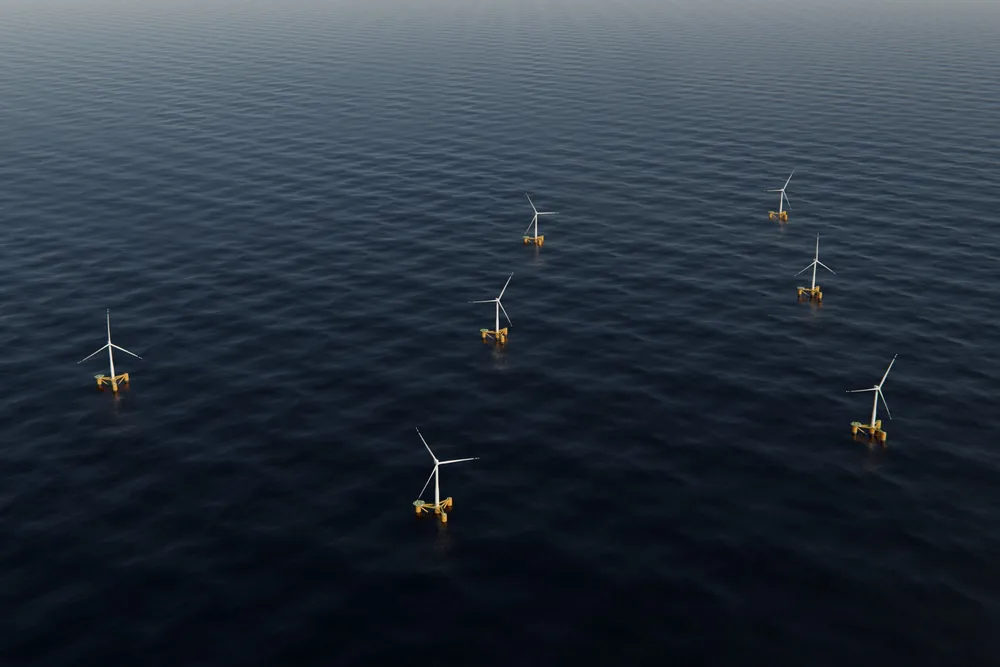

Orsted has sold its 80% stake in Scotland's 100MW Salamander floating offshore wind project to Norway's Odfjell Oceanwind as Denmark's troubled energy giant continues a retrenchment rooted in heavy impairments and ongoing regulatory woes in the US.

The deal, for an undisclosed amount, gives Odfjell Oceanwind a commanding role in a key floating offshore wind demonstrator project where it will be partnered by offshore contractor Subsea7 and the Simply Blue Group.

The Salamander partners had not yet made their design choice known in terms of floating technology to be used.

But Odfjell Oceanwind said in its announcement today (Tuesday) that the project will deploy the company's own Deepsea Star semisubmersible steel foundation.

Located about 35 kilometres off the coast of Peterhead, the Salamander project received full planning consent earlier this year and is qualified to bid in the UK's ongoing AR7 allocation round offering Contracts for Difference for renewable energy.

Salamander was one of several floating offshore wind projects awarded a seabed lease under Crown Estate Scotland’s Innovation and Targeted Oil and Gas (INTOG) round in March 2023.

“The Salamander project share acquisition is a key part of our ambition to make floating wind relevant and commercial through the gradual scale-up in project and wind turbine sizes before reaching utility scale,” said Per Lund, CEO of Odfjell Oceanwind.

“Innovation projects are essential to de-risk relevant floating offshore wind technologies and the supply chain prior to embarking on larger projects like those in ScotWind.”

Odfjell Oceanwind's sister companies Odfjell Technology and Odfjell Drilling have been present in the UK since the 1980s.

Orsted woes

Meanwhile, Orsted has been retreating from non-core markets since it started declaring a stream of heavy losses in the US last year.

This retrenchment began in February 2024, when soaring costs and heavy impairments on the ill-fated Ocean Wind-1 offshore wind project prompted a decision to move away from less mature markets. Floating offshore wind ambitions in Norway, Spain and Portugal were among the first to take the fall.

However, funding pressures will only grow with the latest shock announcement of a Trump Administration order to halt work on the 80% completed Revolution Wind offshore wind farm, on the grounds that it could post a national security threat to the United States.

Orsted also still partners BlueFloat Energy and Nadara (formerly Renantis) on the 1GW Stromar floating offshore wind development off the northeast coast of Scotland.

(Copyright)