Newbie Maersk picked for second giga-scale build as US offshore wind navigates legal minefield

Danish shipping giant's new vessel customised to comply with Jones Act – but sector could face more challenges if Congress approves measure requiring 100% American workforce

Danish shipping giant Maersk added to the project line-up for its new-build wind turbine installation vessel (WTIV) in a US offshore market grappling with potential maritime law obstacles as it prepares for an impending construction boom.

“With this new agreement, we have secured a stable start for our new wind [turbine] installation vessel,” said Jonas Munch, chief commercial officer at Maersk Supply Service.

The issue is even more acute in the US sector due to the Merchant Marine Act of 1920, commonly known as the Jones Act, which forbids foreign-flagged vessels from calling into consecutive American ports or fixed points on the US outer continental shelf (OCS)

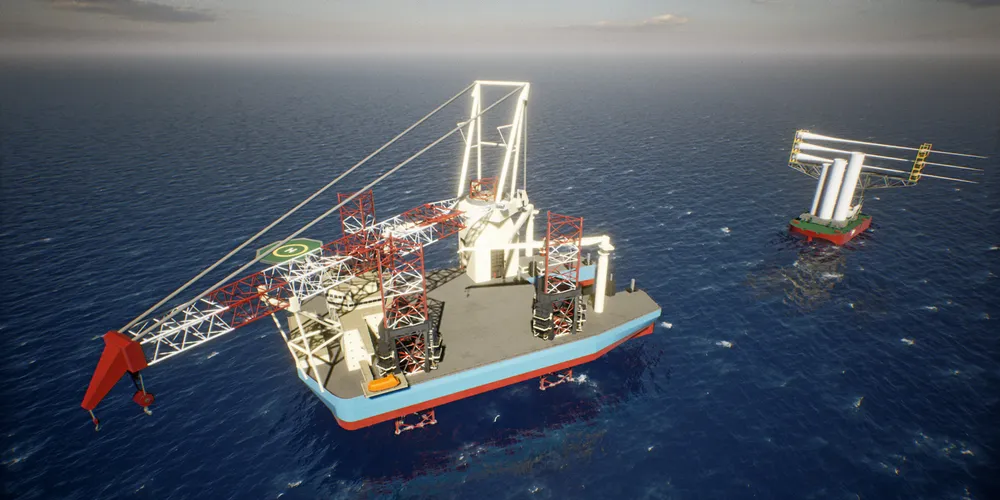

The dearth of US-flagged vessels will require developers to deploy a feeder barge solution in which the installation vessel sits at the site of the wind farm and gets components transferred from American-registered tugs and barges, as was done for the nation’s two offshore wind pilots.

Maersk claims that through patented technology the feeder barge can actually dock directly into the WTIV. This will enable rapid, safe transfer of components between the two vessels and result in savings of 30% or more over conventional WTIV installation methods, “bringing down the levelised costs of offshore wind”, the company said.

US barge operator Kirby is included in the contract to provide two US-flagged tugs and barges for the Empire projects, and will add an additional barge for Beacon.

“This combination of industry leaders [Maersk and Kirby] will expand the US supply chain for offshore wind and create long-term sustainable jobs,” said Benoit Pantin, project director for Beacon Wind.

Congressional risk

While Maersk may have perfected the feeder-barge solution for Jones Act-compliant wind farm construction, the crewing measure slipped into the Coast Guard Authorisation Act of 2022 requiring US or same-flag crew on all vessels operating on the OCS could still present huge challenges.

Offshore wind construction vessels, particularly WTIV, are highly specialised and operate globally, and it would be all-but impossible to replace their crew entirely with US citizens or citizens of the country where the vessel is registered.

Maersk’s vessel is being built in Singapore by Sembcorp Marine and it remains unclear whether it would be flagged in Denmark or Singapore.

Both countries would be hard pressed to meet the possible US crewing requirement, not least due to the booming offshore wind construction sector around the world that will tighten markets for global mariners and installers.

The measure already passed the House of Representatives with strong support from Democrats, and was likewise passed again 14 July as part of the National Defence Authorisation Act of 2023.

“We need Congress to replace this ill-conceived crewing mandate with policy incentives that actually build more US-flagged vessels and train more American mariners,” said Heather Zichal, CEO of American Clean Power Association, an industry advocacy group.

The measure is now being considered in the Senate, where it faces an uncertain fate, with two versions of the defence bill reportedly being considered, with one version containing the crewing provision, and the other without.