New Petrobras boss cooler on 'very expensive' offshore wind than sacked Prates

ANALYSIS | Sector has lost a friend as former CEO is shown the door at state oil giant and incoming chief expresses reservations

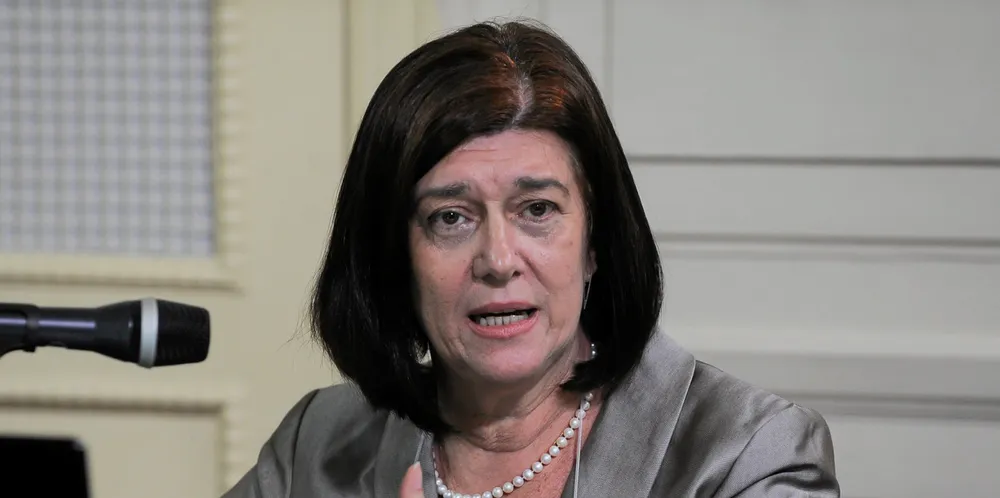

The firing of Jean Paul Prates as CEO of Brazilian oil giant Petrobras looks likely to result in a softening of the company’s lofty ambitions for offshore wind after his successor was named as Magda Chambriard, a former of head of the country’s hydrocarbons and biofuels market regular (ANP).

Prates was sacked by President Luis Ignacio de Lula on Wednesday evening after weeks of tension over the question of how much the profits made by the state-controlled company should be ploughed back into investments as opposed to paid out as dividends.

Prates made an enemy of Brazilian energy minister Alexandre Silveira and lost the support of the president when he abstained on a Petrobras board vote over the proposed retention of extraordinary dividends in March.

In two previous terms in office, running between 2003-2010, Lula de Silva became heavily involved in the strategic thinking at Petrobras and advocated using the company as a “development agent”, thus investing lavishly all over Brazil on diverse job-creating projects ranging from refineries and shipyards to socially-orientated projects such as the production of biofuels using inputs from small-scale farmers in the arid northeast.

Third term

Lula da Silva’s choice of Prates as Petrobras boss when he was elected for a third term last year raised expectations that the oil company would become a major driver of offshore wind development in Brazil.

Prates’ own career is deeply rooted in oil and gas and he spoke in favour of Petrobras continuing to produce oil “to the very last drop”, but he is also a keen enthusiast of wind power.

In a former position as energy secretary of the northeastern state of Rio Grande do Norte Prates was responsible for preparing the ground for a boom in onshore wind investments.

As a senator for that state, he drafted a bill that proposes a regulatory framework for offshore wind.

As head of Petrobras, Prates put his name to several memorandums of agreement setting out the oil major’s intention of becoming an offshore wind developer.

Petrobras has informed the markets that it is engaged in the environmental permitting process for projects in 10 areas with a potential 23GW.

Petrobras is also carrying out joint studies with Norwegian oil and gas major Equinor with a view to developing wind power on seven offshore areas with another 14.5 GW of potential.

As recently as January, Prates was telling investors at a Petrobras event in New York that the company intends to invest $5.2bn to build up 5GW of wind and solar capacity in Brazil as part of its strategy for 2024-2028.

These plans included the acquisition of 2GW of capacity in 2024 and, with prices impacted by unusually high reservoir capacity in Brazil's hydroelectric system, the time seemed to be right for bargain buying in solar and wind.

These acquisitions did not materialise before Prates' demise at Petrobras.

Now the profile of Chambriard suggests that a change of direction on renewables is likely.

As a consultant, Chambriard has spoken out frequently about the need to drill in fresh regions, such as the country's northern offshore "equatorial margin", in order to replenish oil and gas reserves.

Too expensive?

Earlier this week, Chambriard told an investors' event hosted by UBS BB bank that she saw offshore wind, as "very expensive" to deploy.

She cited onshore wind , biofuels and sustainable fuels as "other opportunities" for energy transition business for the oil giant to pursue.

In her comments, to the UBS BB event, Chambriard reportedly argued that Petrobras could put up "more of a fight" to obtain environmental permits to drill in the equatorial margin.

She was referring to a vast maritime area sitting above the mouth of the Amazon river stretching from the border with French Guiana along the entire northern coast of Brazil.

The position of Brazil's environmental agency Ibama in withholding permits for the Foz de Amazonas basin has been backed by Brazilian environment minister Marina Silva, despite fierce pressure from regional leaders in the northern states.

Prates has also spoken in favour of drilling in this region too, but has avoided undermining Ibama.

Since returning for a third term, Lula da Silva has pushed Petrobras to reward investor less and invest more in areas that can boost economic activity and create jobs.

This stance has worried investors, who fear government interference will once again see the state-controlled company piling up debt and creating a fertile ground for corruption.

The company's stock price fell by more than 5% on Thursday, as investors expressed these fears in a major sell off.

(Copyright)