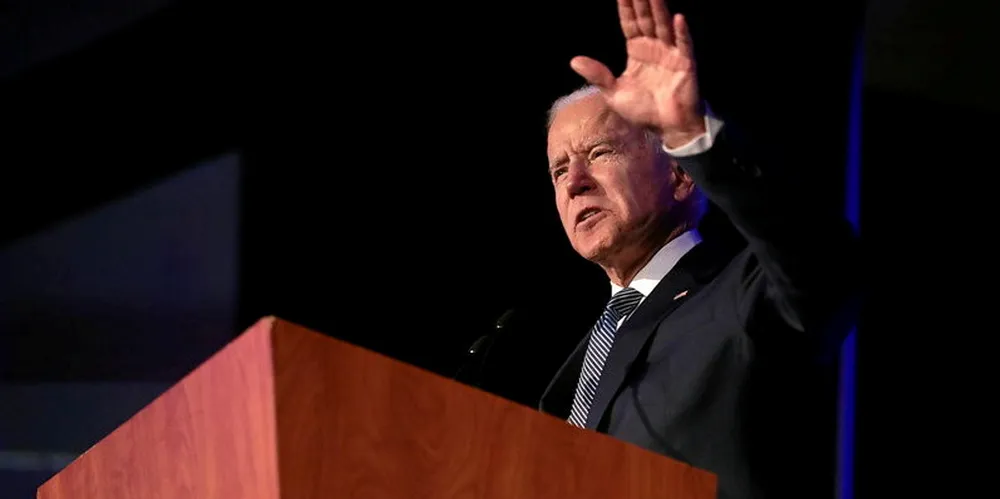

Joe Biden's home state 'in the offshore wind game' at last with grid link to neighbour

Deal with developer means Delaware will be a regional offshore wind player despite having no capacity target

US mid-Atlantic offshore wind laggard Delaware, President Joe Biden's home state, is set to become a player in neighbouring Maryland's gigascale sector ramp-up as a developer taps coastal grid infrastructure for interconnection.

Maryland-based US Wind signed a term sheet Tuesday with Delaware governor John Carney to lease space at Seashore State Park to bring export cables to shore for its 248MW MarWin and 808.5MW Momentum Wind arrays, both contracted to Maryland.

The developer, majority owned by Italian energy firm Renexia, is offering Delaware more than $116m in renewable energy credits (RECs) and community development as well as annual rent payments.

“This agreement means Delaware will become an active player in the growing offshore wind industry,” said governor Carney. “It aligns with other objectives, including our emission reduction targets and meeting the net-zero carbon goal set last year."

Governor Carney signed an executive order in August establishing an offshore wind working group that is expected to release its report on the state's sector opportunities before year's end.

Delaware's available transmission infrastructure at the coal-fired Indian River power plant in Millsboro, some 110 miles (177km) from US Wind’s hub in Baltimore County, will make it important to the Maryland sector's ramp.

Three out of four units at the power plant are shuttered, with the fourth slated for retirement by 2026, freeing up nearly 800MW of grid capacity for offshore wind.

The First State’s robust infrastructure will allow it to play “an important role for the states and the entire region moving their projects forward,” Grybowski said.

“Delaware's in the game,” he added.

The state and developer will hold public hearings prior to finalising the deal.

“From the developer’s perspective, the hardest thing to do in the offshore wind industry is securing interconnection,” Grybowski said, noting that several US projects have failed to gain local and state approvals for onshore cable landings and routing.

“This is a very critical step for the entire Maryland offshore wind programme,” he added.

RECs in the deal

Terms call for US Wind to provide 150,000 RECs annually to Delaware free of charge for 20 years for a total value estimated at $76m.

A REC represents the “environmental, social, and other non-power attributes of renewable electricity generation,” according to the US Environmental Protection Agency, and are issued for each MWh of power delivered to the grid.

MarWin was awarded offshore RECs (ORECs) by Maryland valued at $132/MWh, while Momentum Wind is contracted at $71.6/MWh, according to trade group American Clean Power Association.

MarWin is obligated to feed 900,000MWh annually to Maryland from the MarWin array, and 2.5 million MWh from Momentum.

The developer “will make such RECs (either generated from the Projects or obtained from third parties) available for transfer annually notwithstanding any of its obligations” to Maryland, according to the terms released by the developer.

US Wind would pay annual fees of $350,000 for the beach landing and would provide some $40m towards community benefits over the projects’ lifespans.

The developer would invest another $200m in upgrades for Delaware’s transmission system as well.

The RECs and injection of clean power is expected “to lower regional energy prices and capacity charges by up to $253 million over 20 years”, US Wind said.

The deal with Delaware would be subject to state and local approval and is independent of the federal permitting process.

US Wind’s projects are combined into a single development in the federal permitting regime with a total envelope of 2.2GW.

Offshore energy regulator Bureau of Ocean Energy Management (BOEM has already issued its draft environmental impact statement and the projects will likely be fully approved in the third quarter next year.

(Copyright)