Is Portugal losing the race to build a floating wind industry?

IN DEPTH | Excitement has waned as domestic politics mixes with sector-wide headwinds – but developers haven't given up

Barely six months ago, Portugal was vying to become a leading European destination for floating wind investments, but slow progress in defining a regulatory framework and an unexpected election could now leave Lisbon left behind regional competitors such as Spain and France.

Amid heightened excitement about a promised offshore wind in the Iberian nation last year, some 50 companies responded positively to the Portuguese government's October call for non-binding expressions of interest.

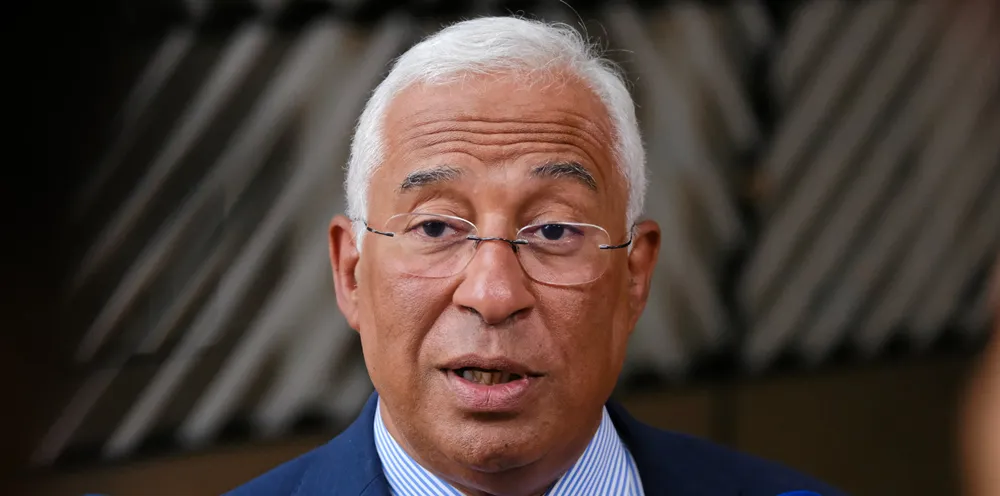

Portugal’s EU-mandated national climate and energy plan (PNEC) set a target of 2GW of offshore wind power capacity in operation by 2030, and Prime Minister Antonio Costa's held this up as one his socialist administration's flagship policies.

Offshore areas were demarcated off Viana do Castelo, Leixoes and Figueira da Foz, under a plan to tender 3.5GW of capacity in 2024, rising to 10GW by 2030. Investments were targeted in the range of €30-€40bn ($32.8-$43.8bn).

Portugal’s standing was boosted by its success in hosting WindFloat Atlantic, the floating wind partnership between Ocean Winds, Repsol and technology provider Principle Power.

A pioneering array of three 8.4MW Vestas turbines housed on semi-submersible hulls has performed well in an ocean environment known for its big waves, supplying the grid without interruption since 2020, when it was first moored in nearly 100 metres of water off Viano do Castelo.

Loss of momentum

Even before this, critics noted that there were some conflicting government signals on matters such as seabed tendering, pricing and grid connections, but the calling of snap elections appeared to slow down the process further.

Doubts about the regulatory and contracting format have grown, with discussions reportedly shifting from a proposed four-stage process, to a two-stage version and — more recently — a one-stop process.

Ideas floated for the remuneration format also shifted from a mix of price and qualitative factors, to discussion of a UK-style contract for difference, leaving developers unsure of the direction to be taken.

Uncertainty has only increased with the political upheaval caused by the resignations and the election campaign.

Cordeiro and Galamba were both key figures in the offshore wind push, and there are growing concerns that Portugal might have lost momentum at a critical time for its nascent offshore wind industry.

One of the most obvious markers of progress, the pre-qualification process for bidders, remains unconcluded going into Sunday's election.

Some say it is no surprise after the non-binding expressions of interest were couched so widely.

Some of the more established wind developers, including Iberdrola, Corio and RWE, have been keen to emphasis the merits of a pre-qualification process that screens for financial solidity and offshore wind experience.

Cold water

Orsted’s strategic pivot away from riskier floating wind destinations was largely a response to its heavy impairments in the US, but reflected a wider reaction to soaring costs and project delays, with portfolio managers becoming more selective.

French floating wind seems to be earning a more favourable rating in this shakeout.

Warning to Portugal

In contrast, BayWa.re’s offshore wind technical director Ricardo Rocha used the recent Wavec seminar – jointly organised by the Dutch embassy in Lisbon — to issue a warning to his home country of Portugal.

“What the Netherlands did in offshore wind, getting from zero to 4.5GW in a little more than 10 years, was exceptional," he said. "They have excellent wind conditions, shallow water depths, as well as a supply chain already contributing to some of the largest monopile fabrications and some of the largest offshore contractors in country.

“But they also set down all the conditions needed to foster that development, It would not have been possible without having the right policy and a good design for the tender rules”.

In comparison, Rocha said, Portugal is entering the contest with “less favourable wind conditions, deeper waters and more to do on grid infrastructure” and is going to the market after the big reset on costs and other considerations.

“So how can Portugal reach this (Dutch) level without the right visibility, without the right policies, or the marine planning that will support what is going to be tendered, "Or without the right visibility on how it is going to be tendered," he asked.

Wild card

Although there are expectations that the next administration will move quickly on offshore wind, a victory for the opposition Social Democratic Party in Sunday's election, would mean a change of government and a settling in period.

On the other hand, Pirrone reckons there has been "a lot going on behind the scenes" in Portugal in recent months, with developers and officials engaging busily over questionnaires and feedback forums.

"In the circumstances, it might have been counterproductive to push the pre-qualification process to a conclusion only to have the whole thing invalidated by a new government wanting to do something differently," she said.

Hung parliament

Although there are expectations that the next administration will move quickly on offshore wind, there are also concerns that the new Portuguese government may suffer from the inertia of a hung parliament.

Portugal’s confederation of industry (CIP) has expressed concern that democracy could be undermined by the polarising trend unleashed by Ventura.

CIP's president, Armindo Monteiro, has urged the established Socialist and Social Democratic parties to forge a bipartisan economic agenda “to stop the country from grinding to a halt”.

Flattering to deceive?

While acknowledging that it is not yet clear how much of the Portuguese regulatory framework has been defined, Pirrone referred to a scenario where Portugal could move quickly after the elections.

She pointed out that Spain's apparent regulatory advance defined some key regulatory responsibilites but left key matters undefined. "In reality you don't know how much capacity will be auctioned. You don't know where it will be. You don't know about commitments to strengthening the grid. You don't know anything about their commitment to ports," she noted.

"If the (Portuguese) government is able to define a roadmap that includes a framework for public private partnerships around ports, I think that we have absolutely the ability to deliver these large scale projects," Aaron Smith, chief commercial officer of Principle Power told the Wavec event.

"There are many examples to learn from. Policymakers are never quite as agile as you'd like them to be, but they can be surprisingly attuned to what is needed to sort of respond."

(Copyright)