Crown Estate parcels up gigascale floating wind zones in Celtic Sea to propel key UK play

British seabed landlord maps out first 'areas for search' ahead of flagship tender next year, with eye on development of almost 25GW by 2045 in waters off England and Wales

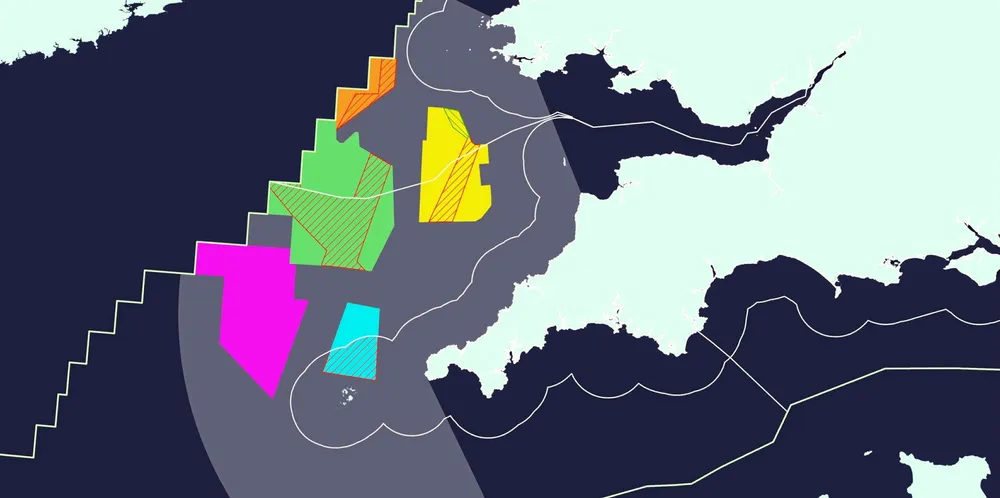

UK seabed landlord the Crown Estate has mapped out five gigascale zones for stepwise development of floating wind arrays in the Celtic Sea, with a view to seeing as much as 24GW online by 2045.

Head of marine new ventures at the Crown Estate, Nicola Clay, said: “The focus in our current programme on delivering the proposed 4GW of floating wind power represents a phased approach, which will provide important lessons at each stage to support and enable the future growth of the sector.

“It gives visibility to a long-term pipeline that will support investment in the regional supply chain and infrastructure, contribute significantly to UK energy security, and help projects in the Celtic Sea reach a scale where they can become more cost-competitive.”

“This proposed leasing round will play a key role in realising green energy ambitions in the Celtic Sea. Separate new research commissioned by The Crown Estate indicates that the Celtic Sea has the economic potential to accommodate up to an additional 20GW of floating offshore wind capacity by 2045,” said the Crown Estate, in a statement.

“The Celtic Sea leasing opportunity will also give developers the option to incorporate innovations such as green hydrogen production, using renewable energy from the offshore floating windfarms, into their projects.”

The areas for search were identified based on “a variety of factors”, according to the Crown Estate, including navigation routes, fisheries activity and environmental sensitivities. “By balancing these and other factors, and incorporating feedback from stakeholders, [these zones] have been assessed as the most favourable locations for floating wind and those most likely to be deliverable in the near term, accelerating secure domestic energy.”