Senators holding Trump's feet to fire on upcoming wind tax credit rules

Two Republican lawmakers are slowing confirmation process for several Trump nominees to ensure eligibility guidance complies with new law

Two Republican senators are slowing the confirmation process for several of President Donald Trump’s nominees until they are certain upcoming Department of Treasury guidance for wind and solar tax credits complies with a law that took effect 4 July.

With the party holding a slim 53-47 majority, the senators and perhaps several others reportedly in agreement with them, could complicate approval of those and other executive branch nominees by the full Senate.

To what extent this ploy could influence Trump's ongoing policy assault on both renewable technologies will play out over the next two weeks.

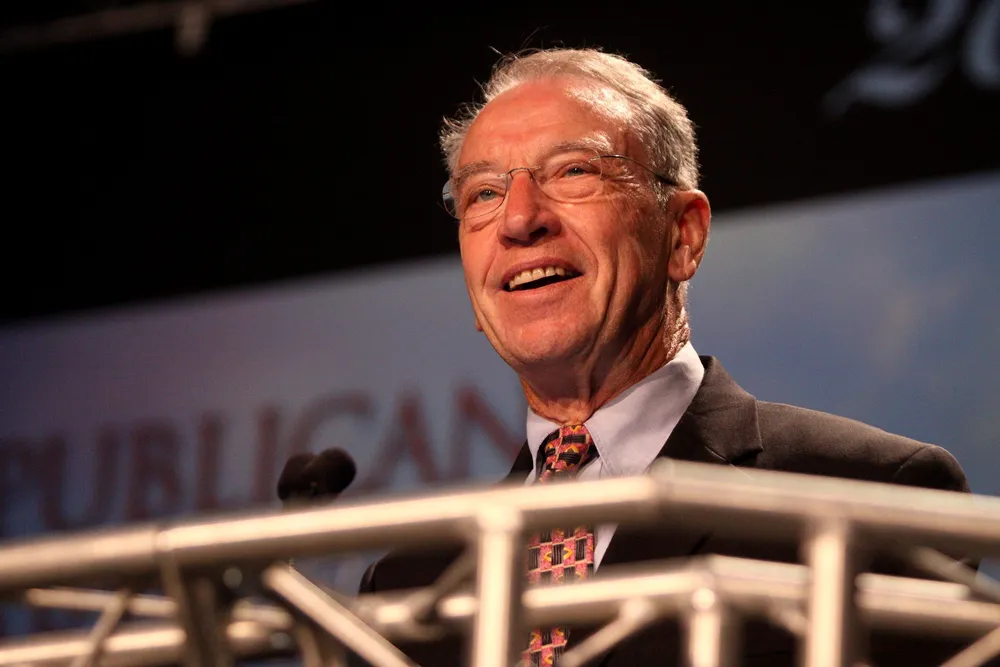

The move by Senators Charles Grassley of Iowa and John Curtis of Utah comes amid growing concern among party moderates and in both industries that the administration will seek to broadly impede access to the credits, perhaps retroactively.

Trump in a 7 July executive order instructed Treasury to adopt a stringent approach to restrict which wind and solar projects qualify for the credits under “start of construction” rule.

His administration asserts that wind and solar developers have somehow abused safe harbours for tax credit eligibility. The order would limit their use “unless a substantial portion of a subject facility has been built.”

Treasury has until 18 August to begin implementing new regulations and rules.

He said during consideration of One Big Beautiful Bill Act (BBB), he worked with other Republican senators to provide wind and solar an “appropriate glidepath” for the orderly phaseout of the tax credits.

Subsequently, Congress in BBB created a 12-month transition period based on when projects begin construction.

The law stipulates that if a project starts construction or spends at least 5% of total capex by 4 July 2026, it has four years of safe harbour to start commercial operation. Beyond that deadline through the end of next year, it would need to come online by 31 December 2027.

“What it means for a project to 'begin construction' has been well established by Treasury guidance for more than a decade,” wrote Grassley. “Moreover, Congress specifically references current Treasury guidance to set that term's meaning in law. This is a case where both the law and congressional intent are clear.”

He added: “Until I can be certain that such rules and regulations adhere to the law and congressional intent, I intend to continue to object to the consideration of these Treasury nominees.”

In recent weeks, the administration has stepped up its rhetoric against wind and solar, while taking steps to prohibit further development of both renewable technologies on federal lands in coastal waters and in the country’s interior.

In 1992, Grassley authored legislation that led to creation of the production tax credit, the main federal subsidy for onshore wind.

(Copyright)