'More selective' | Renewables ramp-up helps Iberdrola to earnings boost

Iberdrola debt upticks on growing investments but $6bn coming from Mexican deal

Rising renewable energy production helped Iberdrola increase earnings by more than 17% in the first nine-months of 2024

The Spanish renewables giant posted a net profit of €3.7bn ($3.9bn) in the first nine months of 2024, compared with €3.1bn in the same period last year.

The company said gross investments of €10.8 billion had helped lift the regulatory asset base of its grid networks business to more than €4bn.

Iberdrola said 3.1GW of renewables were installed over the last 12-months, to reach 41.3GW of installed capacity.

Net revenue during the nine-month period was down 1.9% on the previous year, at €37.2bn due, in part, to lower demand in Spain and the UK, but Iberdrola said operational efficiency and lower energy purchases had also helped boost earnings.

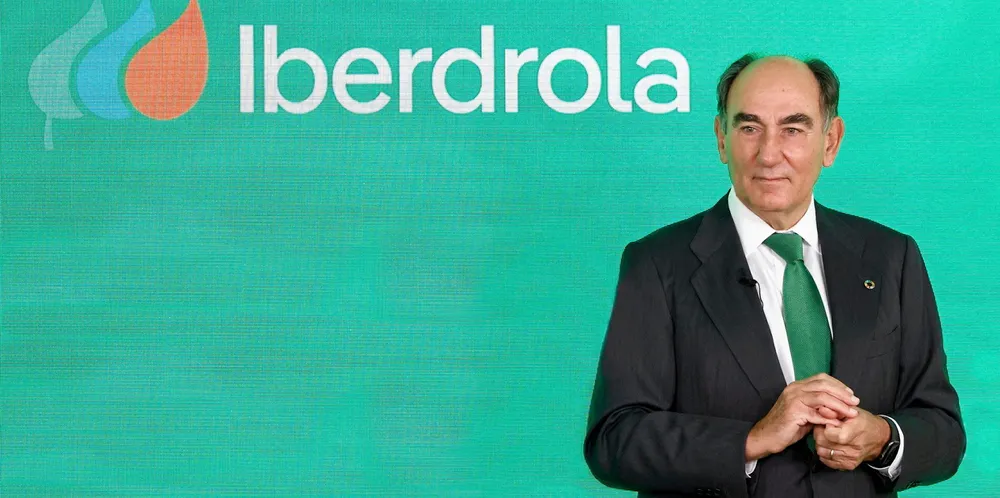

In a call with analysts, Iberdrola executive chairman Ignacio Galan said the company's strategy remains as defined last year as "to maintain financial stability, to grow in networks and be selective in renewables and to invest mostly in countries with a rating."

He said this meant keeping net debt stable, whether through asset rotation or cash flow generated and continuing to invest in networks.

"In renewables we are investing. We have put in service (3.1GW), we have in construction almost 7.1GW and have all offshore wind farms in our plan in a late stage of construction and able to generate cash flow by 2024... but we are more selective and looking for partners," he said.

Mexican assets

Iberdrola said its net profit would have been higher if the impact of a one-off transaction in Mexico were excluded.

In May 2023, the company signed a binding agreement with Mexico Infrastructure Partners to divest a portfolio of 13 Mexican power plants, including combined cycle plants and an onshore wind farm, for $6bn and expects this to be closed by the end of the year.

In July, Iberdrola also signed an agreement with Abu Dhabi based renewables company Masdar to sell it a 49% stake in the Baltic Eagle offshore wind project, located in Germany.

The company announced that its 2023 interim dividend will grow by 11% to €0.20 per share, from €0.18 per share in 2022.

(Copyright)