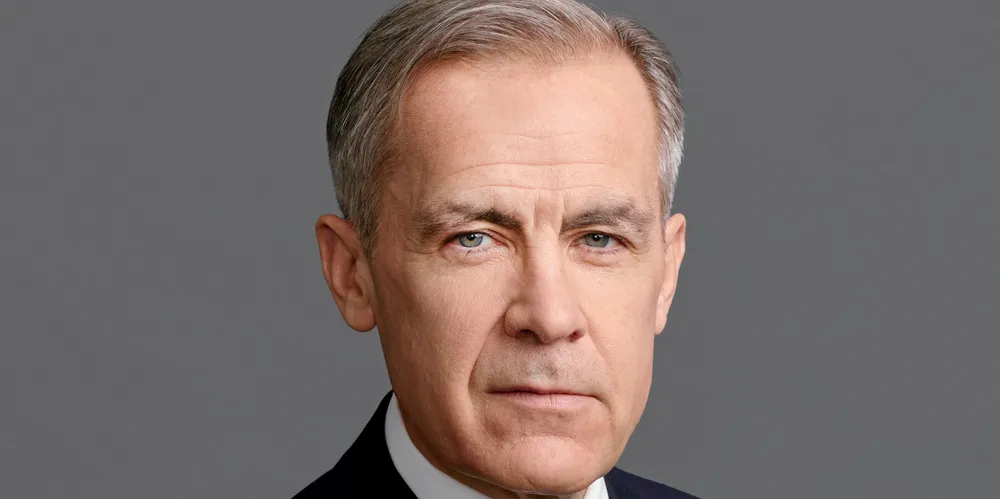

Brookfield eyes record as new Mark Carney-led energy transition fund hits $10bn

Former Bank of England governor is witnessing a surge in interest in energy transition investments in his new job

Canada-based asset management giant Brookfield, has raised $10bn for a new fund which is focused on clean energy and sustainable solutions and co-headed by former Bank of England governor Mark Carney.

Brookfield said the first closing of its second Global Transition Fund (BGTF II) included strategic capital from its own investment base but also reflected "significant support from both existing and new investors".

The fund follows Brookfield's first BGTF which after its final close in 2022 ended with $15bn, claimed as the world's biggest of its type. Brookfield said BGTF II is on course to beat that total, with fundraising expected to conclude in third quarter of this year.

The investment strategy for both funds was stated as "the expansion of clean energy, the acceleration of sustainable solutions and transformation of companies operating in carbon-intensive sectors to more sustainable business models."

The BGTF II seed portfolio includes a UK onshore renewables developer and a solar development partnership in India, but Brookfield described a "robust pipeline" of further investment opportunities.

Brookfield's chair and head of transition investing Carney commented: "We have demonstrated beyond doubt the breadth and scale of attractive investment opportunities in the transition to a net zero economy. By going where the emissions are, the Brookfield Global Transition Fund strategy is aiming to deliver strong risk-adjusted financial returns for investors and make meaningful environmental impacts for people and the planet.”

The Fund's other co-manager, CEO of Brookfield Renewable Power & Transition Connor Teskey, added. “Corporate demand for decarbonisation technologies is now the primary driver of transition investment, delivering significant economic value as well as meaningful environmental benefits. New trends are also emerging, such as supplying reliable, clean power to the surging data and technology sector, building entirely new industrial supply chains, and scaling technologies required for industrial decarbonisation.

"The strong first close for the latest Brookfield Global Transition Fund demonstrates the growing appetite among leading global investors to capitalise on these trends,” he added.

Brookfield said that BGTF Fund II is focused on investments "to accelerate the global transition to a net zero economy while delivering strong risk-adjusted returns for investors".

(Copyright)