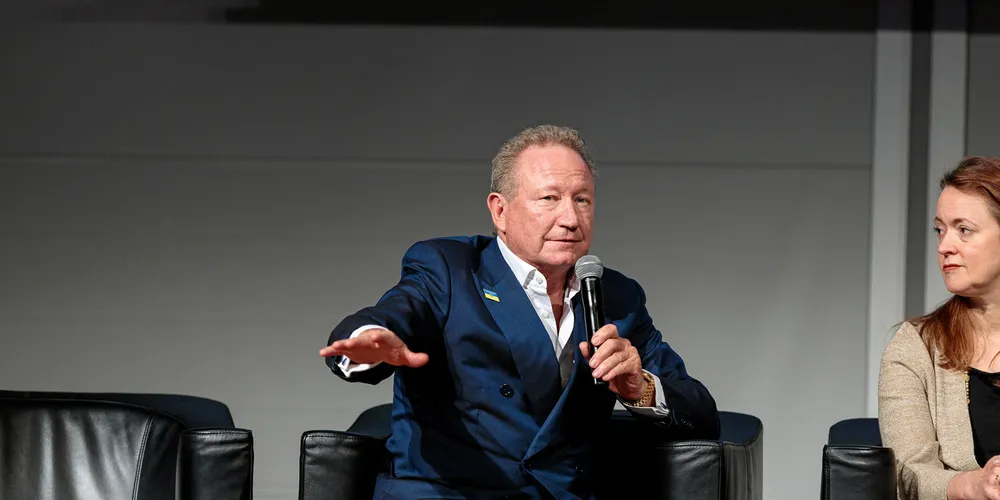

Billionaire Forrest invests €130m in gas terminal in bid to export green hydrogen to Germany from 2026

FFI will become a shareholder in Tree Energy Solutions in a deal that includes joint development of 300,000 tonnes of renewable H2 within four years

FFI’s deal with Belgian “green gas” developer Tree Energy Solutions (TES), announced today (Wednesday), will see FFI become a shareholder in TES for €30m, as well as investing €100m in TES’s flagship project, the Wilhelmshaven Green Energy Hub on Germany’s northwest coast.

It also envisages the two companies fostering a global green hydrogen supply chain together, importing a total of 300,000 tonnes of green hydrogen to Wilhelmshaven by 2026.

Final investment decision on the TES supply chain is scheduled for 2023.

“The United Kingdom and Europe urgently need green solutions to replace fossil fuels and this investment will enable Europe to do exactly that,” said Forrest. “Not in 2050, but in four years from now.”

‘Green gas’

The deal brings FFI on board with TES’s “green gas” import strategy, which it has adapted to Germany’s heightened energy security concerns in the wake of Russia’s invasion of Ukraine in March.

The centrepiece of TES’s strategy is to ship low-cost green hydrogen produced in Saudi Arabia to Wilhelmshaven as “e-methane”, adding one carbon molecule to four hydrogen molecules via the well-established Sabatier methanisation process, to produce synthetic methane which is chemically identical to fossil methane.

As liquefied methane has been shipped around the world for decades — and used as a shipping fuel — the company would be able to sidestep many of the cost and logistical problems faced by those looking to ship liquefied hydrogen or hydrogen-derived ammonia.

Once delivered, the synthetic methane would be reformed to produce green hydrogen, with the carbon captured and shipped back to Saudi Arabia to be reused in more e-methane production, forming a “closed loop” cycle.

But since Germany began scrambling for fossil gas supplies, the company has adapted its strategy to import liquefied natural gas (LNG) from 2025 — and the company had previously said it wouldn’t begin replacing this with e-methane until 2028.

It is not clear how FFI and TES intend to import green hydrogen, and whether they will use the closed-loop system favoured by TES, or opt to import as green ammonia or liquefied hydrogen. The latter has widely been dismissed as too expensive to be a serious contender.

TES was unavailable for comment at the time of writing.

(Copyright)