Biden invokes wartime legislation to ramp up US hydrogen electrolyser production, but what will this mean in practice?

US government to spend federal cash on boosting electrolyser manufacturing through Defense Production Act, but plans could be held back by a lack of critical materials and potentially small budgets

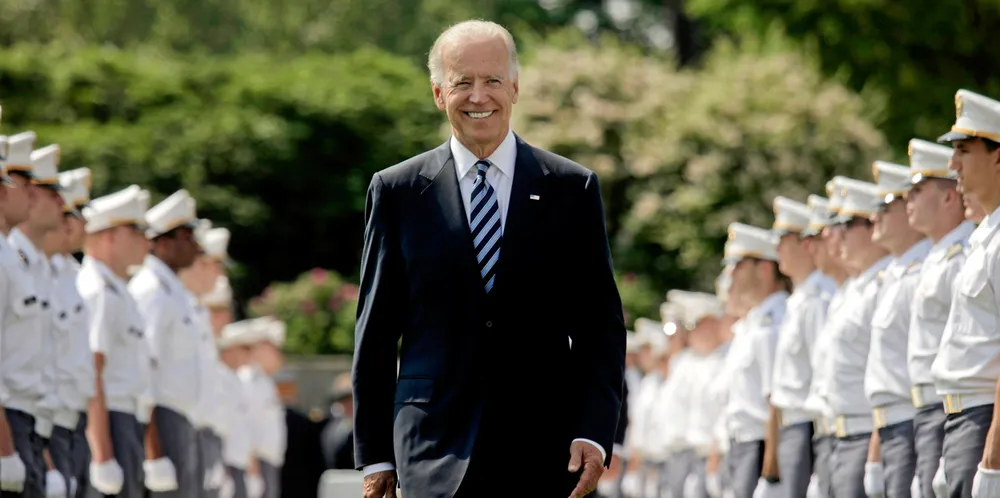

President Joe Biden’s plan to ramp up electrolyser manufacturing capacity and bolster US energy independence in the face of Russia’s invasion of Ukraine could be stymied by the availability of critical materials necessary to build electrolysis technology.

The cash can be used to stimulate manufacturing capacity with direct purchases and government procurement, or for subsidies or capital investments to improve manufacturing facilities. The support can also be applied further down the supply chain, covering raw material exploration and mining, synthesis and purchasing.

Brian Murphy, senior hydrogen and low-carbon fuels analyst at S&P Global Commodity Insights suggests that the DOE is likely to use the DPA funds to address bottlenecks in the supply chain and de-risk private investment.

“This approach may include raw material procurement (especially copper, nickel, and rare metals) and direct purchase agreements or subsidies to incentivise construction of domestic manufacturing facilities,” he notes.

But he warns that this might not be sufficient to incentivise significant ramp-up in electrolyser manufacturing capabilities.

Spread too thin?

Moreover, there is significant uncertainty around how much of the DPA’s $545m budget — set for the whole of 2022 — will be available to stimulate electrolyser production.

Biden has also tasked the DOE with ramping up US manufacturing capability in solar panels, transformers and other grid components, heat pumps and hydrogen fuel cells.

“DOE will be limited by the amount of funding available, as there was no figure given to how much will be allocated specifically to each technology,” said Matthew Williams, energy policy analyst at S&P Global Commodity Insights. “Naturally, a dollar spent on solar or heat pumps is a dollar that won’t be spent on electrolysers.”

The DOE will also have to share the $545m budget with the Department of Defence and Department of Health, which have been authorised this year to use it for procuring critical minerals and baby formula, respectively.

However, Congress does have the option of appropriating more funds to the DPA budget if it sees fit.

And the DOE has already indicated that it will prioritise private sector activity on electrolyser manufacture, which could give some clues as to how it will proceed with this mandate, says Williams.

“Discussions regarding hydrogen and electrolysis particularly focused on engagement with the private sector to explore the idea of a hydrogen reserve and developing utility ownership structures and regulatory support,” he explains.

Defense Production Act

First enacted around the time of the Korean war in the 1950s, the DPA grants federal government powers to incentivise, stimulate or even control US manufacturing capability with the aim of warding off imminent supply-chain problems and shore up domestic capacity in times of war or crisis.

“President Biden’s actions supporting domestic supply chains for electrolysers, fuel cells, and PGM catalysts will enhance national and energy security by reducing US reliance on imported fossil fuels, particularly Russia, the world’s second-largest producer of platinum group metals (PGM), and China,” the DOE said this week. “Consumers will benefit from clean hydrogen’s price stability relative to fossil fuels, cost reductions as the hydrogen economy scales up, and resilient domestic supply chains.”

Currently, the US hosts just one operational commercial electrolyser factory, a 50MW facility operated by Norway’s Nel in Wallingford, Connecticut. Plug Power’s 500MW factory in New York state is scheduled for completion this year, after construction began in March.

The DOE hopes to raise US electrolyser manufacturing capacity to its full potential of 100GW by 2050, according to a supply-chain policy document it published in February.

The DPA invocation was welcomed by hydrogen advocates and industry analysts alike, who agreed that the US is lagging on electrolyser manufacture.

“This is a crucial move to bring the US up to speed in advanced manufacturing at scale in the hydrogen space,” said Patrick Molloy, manager in the climate-aligned industries programme at RMI. “The US is playing catch up with gigawatt-scale announcements in Europe and Asia. These announcements will help accelerate capacity development in North America.”

US industry association Hydrogen Forward gave it a glowing review, saying would secure US clean energy capability for “decades to come”.

“This latest action continues to demonstrate the administration’s long-term commitments to stable economic growth while transitioning to clean energy solutions, including hydrogen,” the association added.

(Copyright)